Learn by Concept

Simple and Compound Interest

Branch: Algebra

When you lend something to someone for a certain period, the other party is ideally supposed to give you that object back in one piece and is also supposed to compensate for borrowing it. Imagine you going to a tourist destination. You may or may not have a place of your own to live there. In the case of the latter, you obviously will have to take a hotel room on rent and vacate it dutifully at the end of your stay and pay the rent. Similarly, when you borrow money from an entity like a person or a bank, you’re expected to compensate for the money borrowed with interest. It can be stated that this money charged on the sum borrowed can be termed as the rent. This rent is called interest. It can be calculated in two ways, namely simple interest and compound interest.

Now that we’ve understood the meaning of the term ‘interest’, let us dive into the two sorts of it:

1) Simple interest:

When the interest is charged on the original amount that is lent to the borrower, it is termed as simple interest. In simple interest, the interest is charged only on the money principally lent. The amount payable at the end of the term includes the actual amount plus the interest charged on the same amount.

Simple Interest Formula

The formula when simple interest (SI) is charged annually:

SI = P*R*N/100

where Principal (P) = The money that a borrower borrows from the lender

Rate (R) = The yearly rate of interest

Number of Years (N) = The total number of years for which money is lent

The total amount payable at the end:

Amount payable (A) = P (Principal) + SI (Simple Interest)

Simple and Compound Interest Example:

Q.1) Sarah wants to borrow a sum of Rs. 25,000 from the bank for two years. The bank charges simple interest at a rate of 10 % per annum. What will be the amount that Sarah will have to pay at the end of those two years?

Solution: We know that the principal = 25,000 , rate of interest = 10 and the total number of years = 2

∴ SI = P*R*N/100

= 25000*10*2/ 100

= 5000

Now, A = P + SI

∴ A = 25000 + 5000

= 30000

Hence, the amount payable by Sarah is Rs. 30,000.

2) Compound Interest:

When interest is first paid on the principal amount and then again on the amount gained by adding the principal and the accumulated interest, it is termed as compound interest. For instance, Banks pay compound interest on their customers’ fixed deposits.

Compound Interest Formula

The formula when compound interest (CI) is charged annually:

CI = A – P , A = P (1 + R/100)N

where Amount (A) = The final amount accumulated at the end of transaction carried out based on compound interest.

Principal (P) = The original amount invested or lent

Rate (R) = The yearly rate of interest

Number of Years (N) = The total number of years

Important Formulae in compound interest:

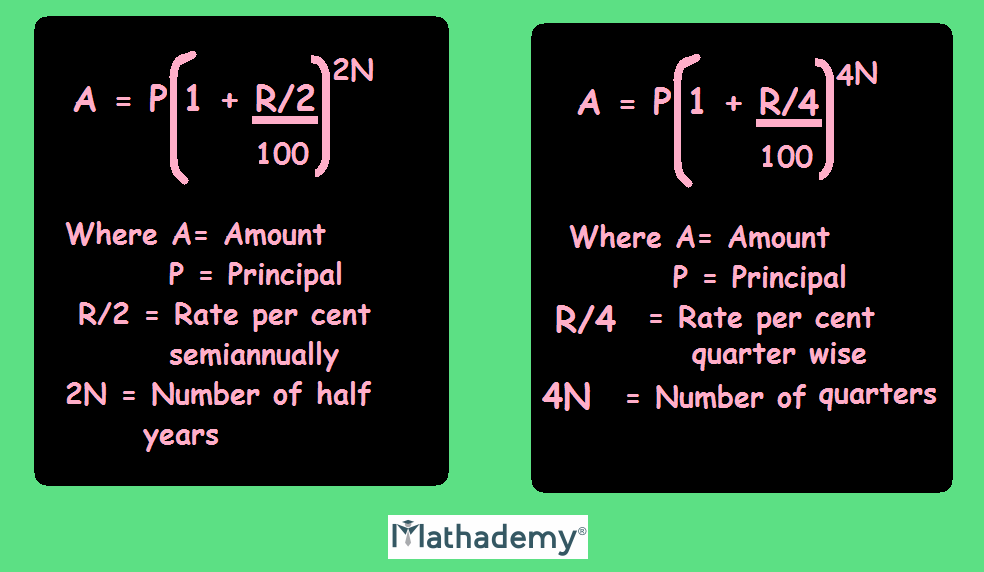

Interest may not always be compounded on an yearly basis. It may be paid semiannually or quarterly.

Difference between Simple Interest and Compound Interest

| Parameter | Simple Interest | Compound Interest |

|---|---|---|

| Definition | When the interest is charged on the initial amount that is lent to the borrower, it is called simple interest | When the interest is calculated on the initial amount and the interest accumulated over a period of time is called as compound interest. |

| Formula | S.I = P*R*T/100 | C.I = P(1+R/100)n-P |

| Amount | The Amount is lesser than Compound Interest | The amount is much higher than Simple Interest |

| Principal | The Principal is constant through out the time period. | The principal keeps changing through out the time period. |

| Growth Rate | The growth rate is linear in Simple Interest | The growth rate is exponential and increases rapidly in Compound Interest. |

Simple and Compound Interest Example:

Q.2) If Anisha borrows Rs 2,00,000 at 5% C.I. for 2 years. Calculate the amount that she will have to pay after two years.

Solution: We know that P = 2,00,000 , R = 5% , N = 2 years

We know that A = P (1 + R/100)N

∴ A = 200000( 1 + 5/100)2

= 200000( 1 + 0.05)2

= 200000( 1.05)2

= 200000 * (1.1025)

=220500

∴ Anisha will have to pay an amount of Rs 2,20,500.

Simple and Compound Interest Example:

Q.3) Diana borrows a sum P on both simple interest and compound interest for 2 years at 4% per annum. Difference between simple and compound interest compounded annually on P for 2 years at 4% per annum is Re. 1. Calculate the sum.

Solution: We know that P = P, R = 4 % , N = 2

We know that simple interest = PRN/100 = P*4*2/100 = P*8/100 = 2P/25

We know that Compound Interest = A – P

A = P (1 + R/100)N

∴ C.I. = P (1 + 4/100)2 - P

= P ( 1 + 1/ 25)2 – P

= P ( 26/25)2 – P

= P (676/625 - 1)

= 51P/625

We know that Difference between simple and compound interest is Rs. 1

Hence, 51P/625 - 2P/25 = 1

∴ (51P – 50P)/625 = 1

∴ 1P/625 = 1

∴ P = 625

Simple and Compound Interest Example:

Q.4) Reeva borrows a sum of Rs 1,60,000 for one year at the rate of 20% per annum, and the interest is compounded every 3 months. Find the amount of compound interest.

Solution: We know that when interest is compounded every 3 months, it is compounded quarterly.

We know P = Rs 1,60,000 , R = 20% = 20/4 = 5% per quarter and

N = 1 year = 1 × 4 = 4 quarters

We know that A = P (1 + R/100)N

= 160000 (1 + 5/100)4

= 160000 (105/100)4

∴ A = Rs. 1,94,481

∴ Compound Interest = A – P = Rs 194481 – Rs 160000 = Rs 34,481

Simple and Compound Interest Example:

Q.5) Tazeen took a loan of Rs. 20,000 from her friend Meera at 18% per annum simple interest. She lent the same amount to Simran at the same rate but compounded annually. Find her gain after 2 years.

Solution: We know that P = Rs 20,000 , R = 18 % , N= 2 years

We know that Simple interest = P*N*R/100 = 20000*18*2/100 = 7200

Interest that Tazeen must pay to Meera = Rs. 7200

We know that A = P (1 + R/100)N

= 20000 (1 + 18/100)2

= 20000 (118/100)2

= Rs 27,848

Now, Compound Interest (CI) = A – P = 27848 - 20000 = Rs 7848

∴ Interest Simran will have to pay to Tazeen is Rs. 7848

Now, Tazeen’s gain = Interest she earned from Simran – interest she paid to Meera

∴ Tazeen’s gain = Rs. (7848 – 7200) = Rs. 648

FAQs on Simple Interest and Compound Interest

Q. What is the difference between Simple Interest and Compound Interest?

A. When the interest is charged on the initial amount that is lent to the borrower, it is called simple interest. Whereas when the interest is calculated on the initial amount and the interest accumulated over a period of time is called as compound interest.

Q. What is the formula for Simple Interest?

A. The formula for Simple Interest is P*R*T/100, where P is the Principal, R is the Rate of Interest, T is the Time Period.

Q. What is the formula for Compound Interest?

A. The formula for Compound Interest is A - P, where A is the Amount which is calculated using the formula P(1+R/100)n, where P is the Principal, R is the Rate of Interest, n is the total number of years.

Q. What are some Simple Interest examples in real life?

A. Simple Interest is used widely in banks. The banks apply simple interest on loans, such as car loans, student loans,consumer loans etc. The interest is calculated on the initial amount of the loan.

Q. What are some Compound Interest examples in real life?

A. Compound Interest is mainly used in investments such as savings account, mutual funds etc. The interest is calculated on the initial principal and the interest accumulated over a period of time of investment.